Exploring Pattern Causality: An Intuitive Guide

Stavros Stavroglou, Athanasios Pantelous, Hui Wang

Source:vignettes/patterncausality.Rmd

patterncausality.RmdPattern Causality is a novel approach for detecting and analyzing causal relationships within complex systems. It is particularly effective at:

- Identifying hidden patterns in time series data: Uncovering underlying regularities in seemingly random data.

- Quantifying different types of causality: Distinguishing between positive, negative, and “dark” causal influences, which are often difficult to observe directly.

- Providing robust statistical analysis: Ensuring the reliability of causal inferences through rigorous statistical methods.

This algorithm is especially useful in the following domains:

- Financial market analysis: Understanding the interdependencies between different assets.

- Climate system interactions: Revealing the complex relationships between various factors in climate change.

- Medical diagnosis: Assisting in the analysis of disease progression patterns to identify potential causes.

- Complex system dynamics: Studying the interactions between components in various complex systems.

Application in Financial Markets

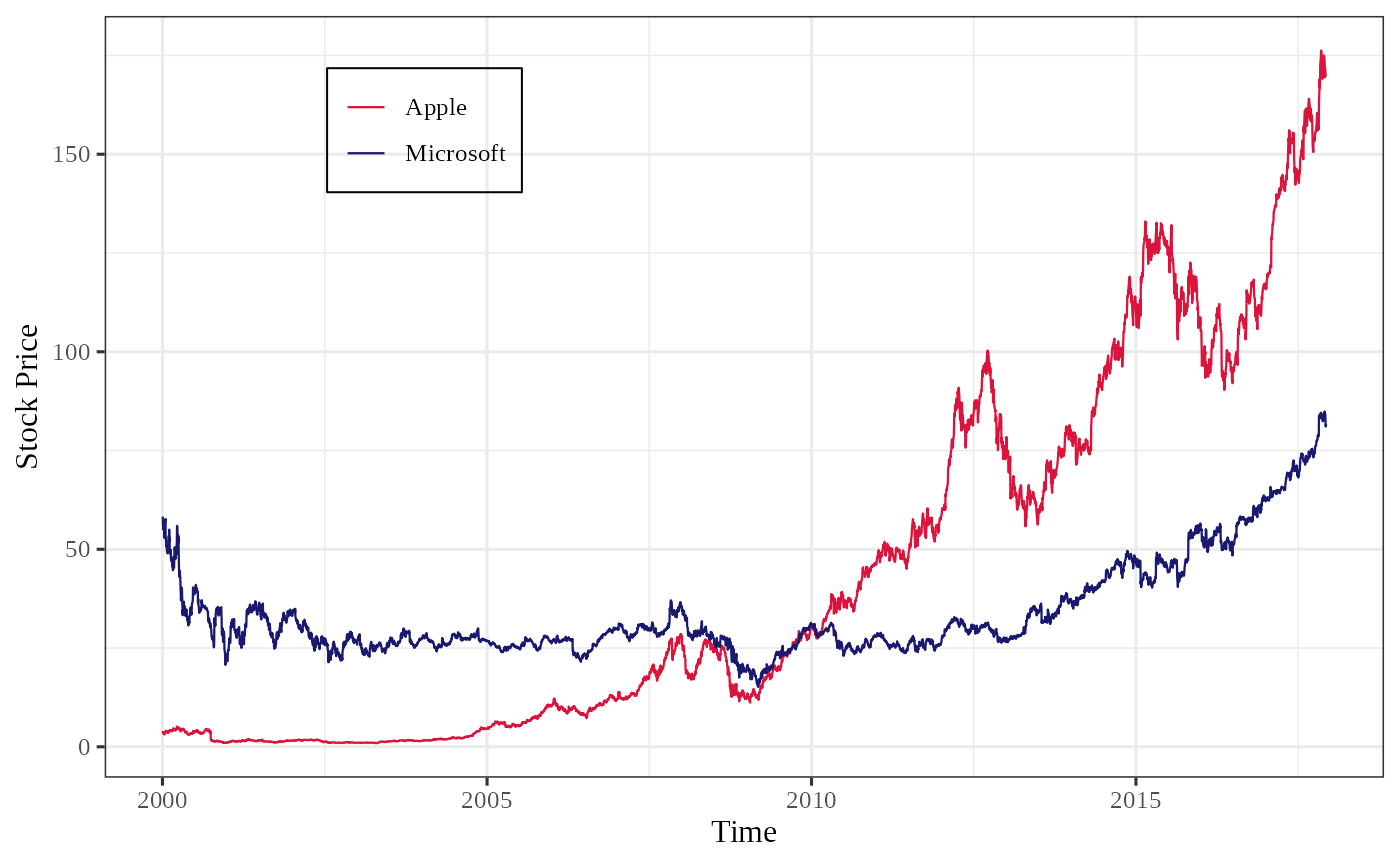

First, we import stock data for Apple (AAPL) and Microsoft (MSFT). You can also import data using the yahooo API.

library(patterncausality)

data(DJS)

head(DJS)

#> Date X3M American.Express Apple Boeing Caterpillar

#> 1 2000-01-03 47.1875 45.88031 3.997768 40.1875 24.31250

#> 2 2000-01-04 45.3125 44.14794 3.660714 40.1250 24.00000

#> 3 2000-01-05 46.6250 42.96264 3.714286 42.6250 24.56250

#> 4 2000-01-06 50.3750 43.83794 3.392857 43.0625 25.81250

#> 5 2000-01-07 51.3750 44.47618 3.553571 44.3125 26.65625

#> 6 2000-01-10 51.1250 45.09618 3.491071 43.6875 25.78125

#> Chevron Cisco.Systems Coca.Cola DowDuPont ExxonMobil

#> 1 41.81250 54.03125 28.18750 44.20833 39.15625

#> 2 41.81250 51.00000 28.21875 43.00000 38.40625

#> 3 42.56250 50.84375 28.46875 44.39583 40.50000

#> 4 44.37500 50.00000 28.50000 45.64583 42.59375

#> 5 45.15625 52.93750 30.37500 46.66667 42.46875

#> 6 43.93750 54.90625 29.40625 45.47917 41.87500

#> General.Electric Goldman.Sachs IBM Intel Johnson...Johnson

#> 1 50.00000 88.3125 116.0000 43.50000 46.09375

#> 2 48.00000 82.7500 112.0625 41.46875 44.40625

#> 3 47.91667 78.8750 116.0000 41.81250 44.87500

#> 4 48.55727 82.2500 114.0000 39.37500 46.28125

#> 5 50.43750 82.5625 113.5000 41.00000 48.25000

#> 6 50.41667 84.3750 118.0000 42.87500 47.03125

#> JPMorgan.Chase McDonald.s Merck Microsoft Nike Pfizer

#> 1 48.58333 39.6250 67.6250 58.28125 6.015625 31.8750

#> 2 47.25000 38.8125 65.2500 56.31250 5.687500 30.6875

#> 3 46.95833 39.4375 67.8125 56.90625 6.015625 31.1875

#> 4 47.62500 38.8750 68.3750 55.00000 5.984375 32.3125

#> 5 48.50000 39.8750 74.9375 55.71875 5.984375 34.5000

#> 6 47.66667 40.0625 72.7500 56.12500 6.085938 34.4375

#> Procter...Gamble The.Home.Depot Travelers United.Technologies

#> 1 53.59375 65.1875 33.0000 31.25000

#> 2 52.56250 61.7500 32.5625 29.96875

#> 3 51.56250 63.0000 32.3125 29.37500

#> 4 53.93750 60.0000 32.9375 30.78125

#> 5 58.25000 63.5000 34.2500 32.00000

#> 6 57.96875 63.1875 33.6250 32.31250

#> UnitedHealth.Group Verizon Walmart Walt.Disney

#> 1 6.718750 53.90316 66.8125 29.46252

#> 2 6.632813 52.16072 64.3125 31.18836

#> 3 6.617188 53.90316 63.0000 32.48274

#> 4 6.859375 53.28487 63.6875 31.18836

#> 5 7.664063 52.89142 68.5000 30.69527

#> 6 7.531250 52.61038 67.2500 35.37968The data(DJS) function loads the Dow Jones stocks

dataset, which includes daily stock prices for several companies,

including Apple and Microsoft. The head(DJS) function

displays the first few rows of the dataset.

Next, we visualize the stock prices to observe their trends more intuitively.

Parameter Optimization

To achieve the best results with pattern causality analysis, it’s

important to find the optimal parameters. The following code

demonstrates how to search for these parameters using the

optimalParametersSearch function (note that this code is

not evaluated by default due to the time it may take).

dataset <- DJS[,-1]

parameter <- optimalParametersSearch(Emax = 5, tauMax = 5, metric = "euclidean", dataset = dataset)Calculating Causality

After determining the parameters, we can calculate the causality between the two series.

X <- DJS$Apple

Y <- DJS$Microsoft

pc <- pcLightweight(X, Y, E = 3, tau = 2, metric = "euclidean", h = 1, weighted = TRUE)

print(pc)

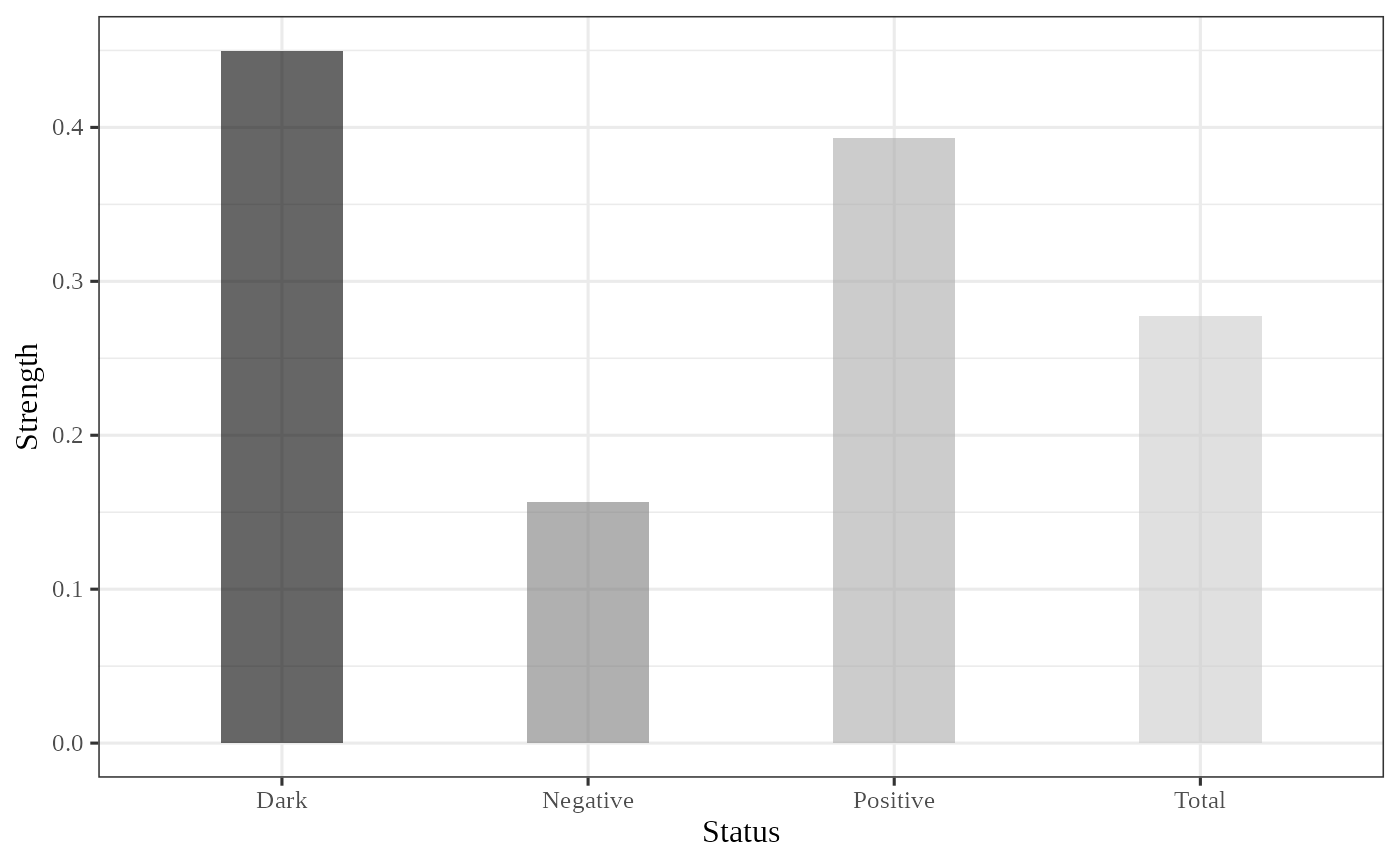

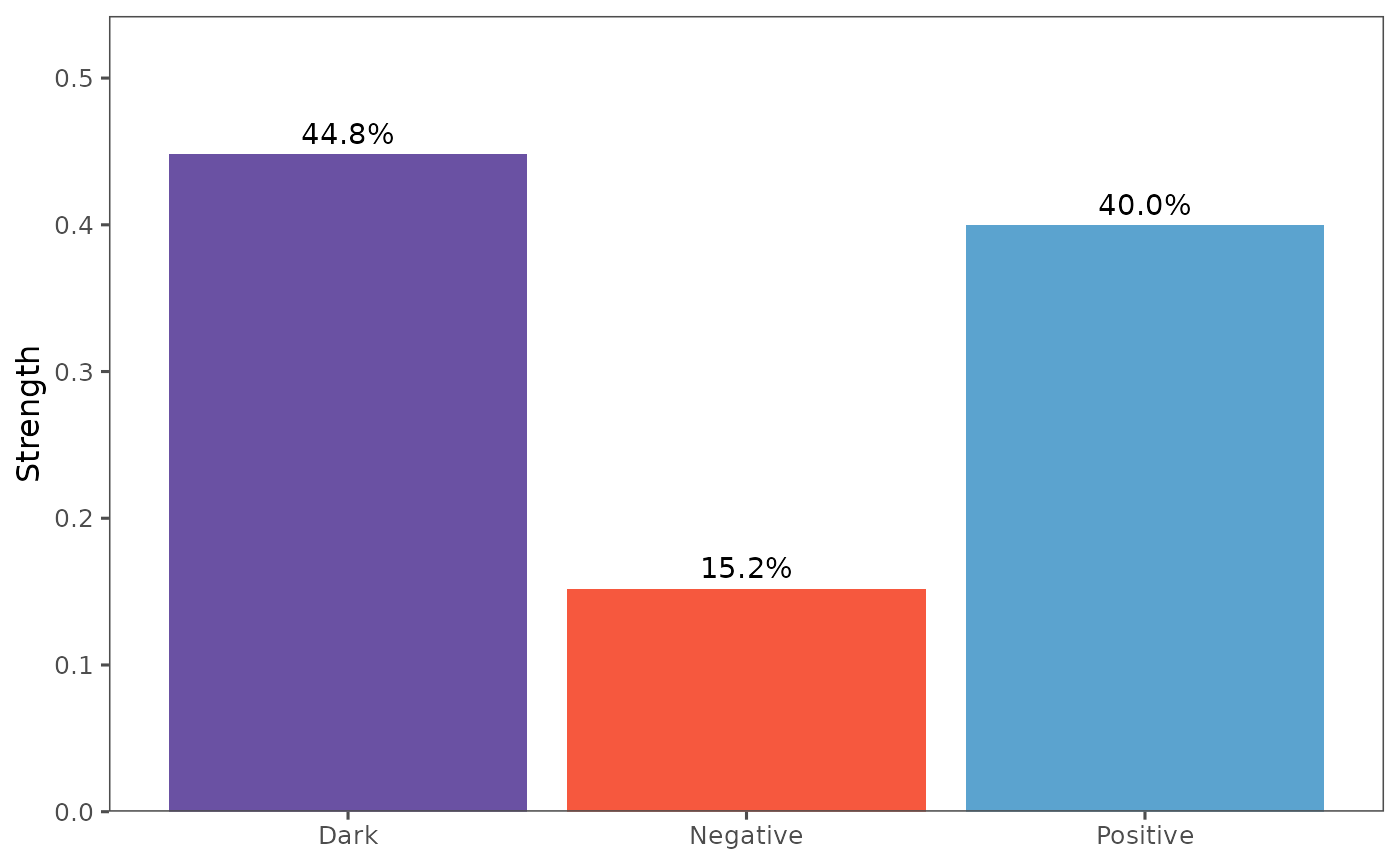

#> Pattern Causality Analysis Results:

#> Total: 0.2756

#> Positive: 0.4095

#> Negative: 0.1454

#> Dark: 0.4451The pcLightweight function performs a lightweight

pattern causality analysis.

The print(pc) method displays the results of the

causality analysis, including the total, positive, negative, and dark

causality percentages.

Finally, we can visualize the results to better understand the causal

relationships using the plot_total and

plot_components functions.

plot_total(pc)

plot_components(pc)

The plot_total function visualizes the total causality,

and plot_components visualizes the different components of

causality (positive, negative, and dark).

Detailed Analysis

For more detailed causality information, use the

pcFullDetails function.

X <- DJS$Apple

Y <- DJS$Microsoft

detail <- pcFullDetails(X, Y, E = 3, tau = 2, metric = "euclidean", h = 1, weighted = TRUE)

# Access the causality components

causality_real <- detail$causality_real

causality_pred <- detail$causality_pred

print(causality_pred)This completes the entire process of the pattern causality algorithm.

Parameter Description

The pattern causality functions accept several important parameters:

-

E: Embedding dimension (integer > 1) -

tau: Time delay (integer > 0) -

metric: Distance metric (“euclidean”, “manhattan”, or “maximum”) -

h: Prediction horizon (integer >= 0) -

weighted: If TRUE, uses weighted causality strength calculation -

relative: If TRUE, calculates relative changes ((new-old)/old) instead of absolute changes (new-old) in signature space. Default is TRUE.

The combination of weighted = TRUE and

relative = TRUE is particularly useful when: 1. You want to

analyze percentage changes rather than absolute changes 2. The time

series have different scales or units 3. You’re interested in the

relative importance of changes

# Example with both weighted and relative TRUE

pc_rel_weighted <- pcLightweight(X, Y, E = 3, tau = 2, metric = "euclidean",

h = 1, weighted = TRUE, relative = TRUE)

print(pc_rel_weighted)

#> Pattern Causality Analysis Results:

#> Total: 0.2756

#> Positive: 0.4095

#> Negative: 0.1454

#> Dark: 0.4451