Either in the form of nature's wrath or a pandemic, catastrophes cause major destructions in societies, thus requiring policy and decisionmakers to take urgent action by evaluating a host of interdependent parameters, and possible scenarios. The primary purpose of this article is to propose a novel risk-based, decision-making methodology capable of unveiling causal relationships between pairs of variables.

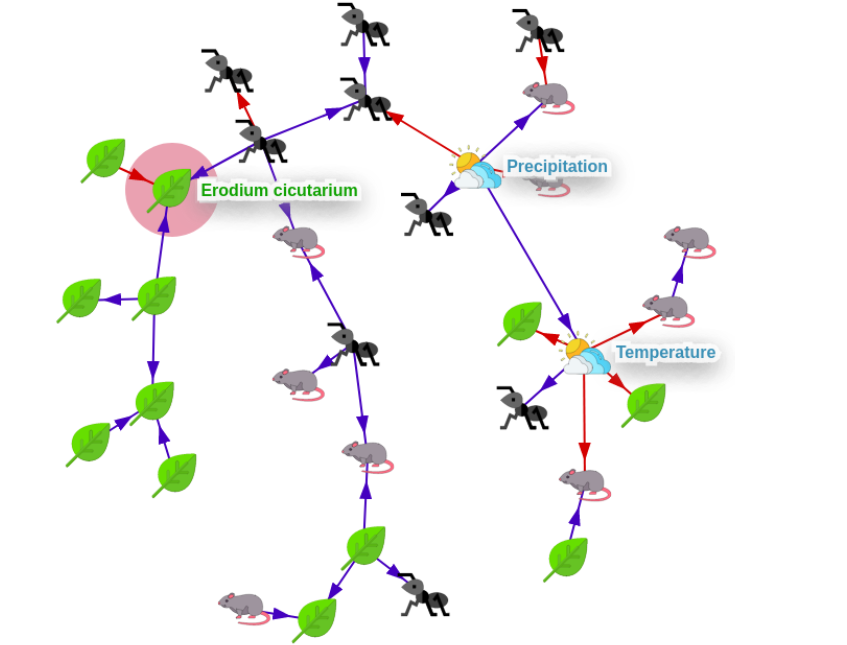

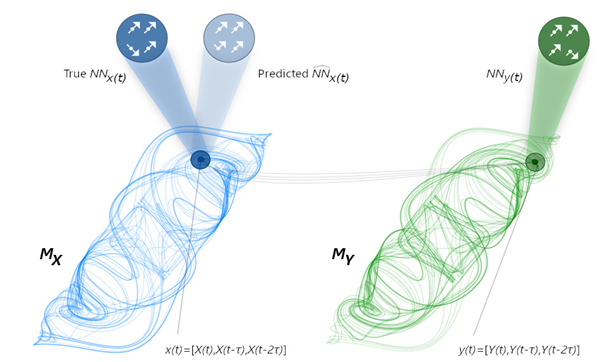

Patterns in nature and society are described as complex systems due to their complicated and highly interconnected properties. Capturing the ebb and flow of their structures sheds a light on our better understanding of nature’s rules and social connectedness. In this context, a methodology is proposed that unveils the most important operations and components of complex systems. The method’s power is effectively demonstrated by reconstructing the essential structure of a desert ecosystem, discovering distinguishing features of the alcoholic brain, and locating key assets in the CDS market.

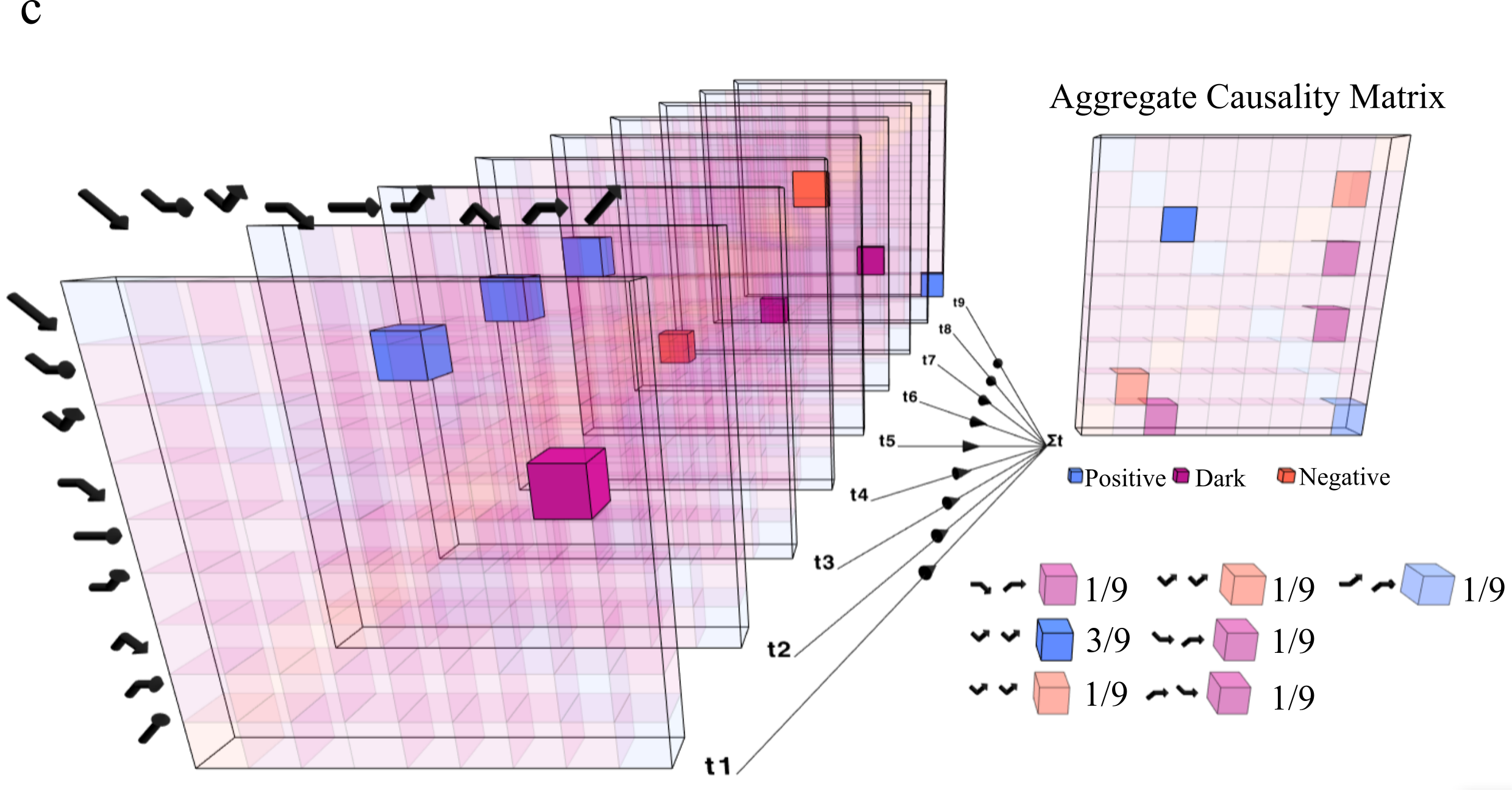

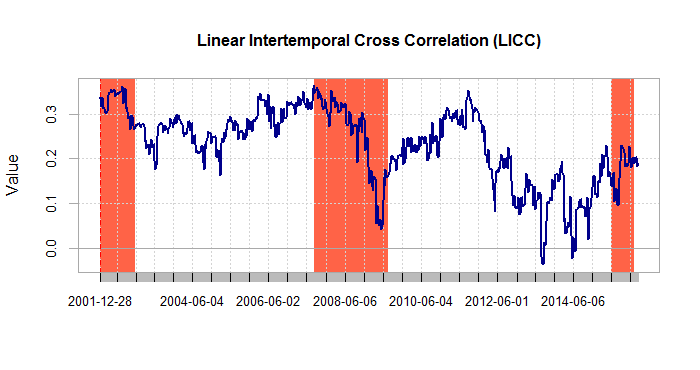

The importance of understanding the structure of financial markets has been progressively coming to a head in public discourse. With the rise and prevalence of big datasets, it is a crucial time for academics to study the interdependency outside conventional analysis. Thus, the methodology proposed in this paper does not only allow distinction between positive and negative interdependence, but additionally identifies a yet unexplored form of interaction we coin as “dark causality.”

Through financial network analysis we ascertain the existence of important causal behavior between certain financial assets, as inferred from eight different causality methods. To the best of our knowledge, this is the first extensive comparative analysis of financial networks as produced by various causality methods. In addition, some specific nonlinear causalities are used for the first time in financial network research.